Fund of Hedge Funds

A fund of hedge funds is a portfolio of hedge funds managed by a specialist team. This section provides a simple example to illustrate how investors can assemble a portfolio of high-quality funds and the power of such a portfolio. We also discuss circumstances where a fund of hedge funds is preferable to managing a portfolio of your own. It covers the following topics:

Our objective in this example is to achieve superior absolute and risk-adjusted returns with low correlation to the broad equity market, using S&P 500 as the benchmark. We want our portfolio to be broadly diversified and relatively liquid. Its investment universe encompasses all liquid asset classes including equities, bonds, commodities, currencies, and others. It is open to fundamental, technical, quantitative, and other investment strategies.

We collect fund data from our contacts, industry publications and events, online and database searches, and calling and visiting fund managers. To qualify as a candidate a fund must have equity-like returns and allow monthly or quarterly subscriptions and redemptions. The funds must have a minimum size of roughly US$100 million, use modest leverage, and be open to new investors. Candidates must also have a monthly return record of around 5 years or more, outperforming benchmarks in absolute and risk-adjusted returns.

Once we have shortlisted the potential candidates, we follow a process outlined in the Hedge Fund Selection to research and select funds for the portfolio.

The main goal of a portfolio is to diversify while achieving a specific risk and return objective. “Diversification is the only free lunch” in investing, as one Nobel laureate reputedly quipped. However, discussions on portfolio construction can either be too generic or overly mathematical. This section describes a common-sense approach to construct an example portfolio with 20 actual funds.

Using the S&P 500 index as the benchmark, we begin with equity long-short funds, which usually offer higher returns and larger capacities. The portfolio chooses a fund with the lowest correlation with our benchmark during market declines as the first fund.

Successively the portfolio adds up to 19 additional funds, each of which has a low correlation to market declines, and a low correlation with the portfolio. We balance correlation, performance, asset class, and fund types to avoid over-concentration in any specific region, asset class, or investment strategy.

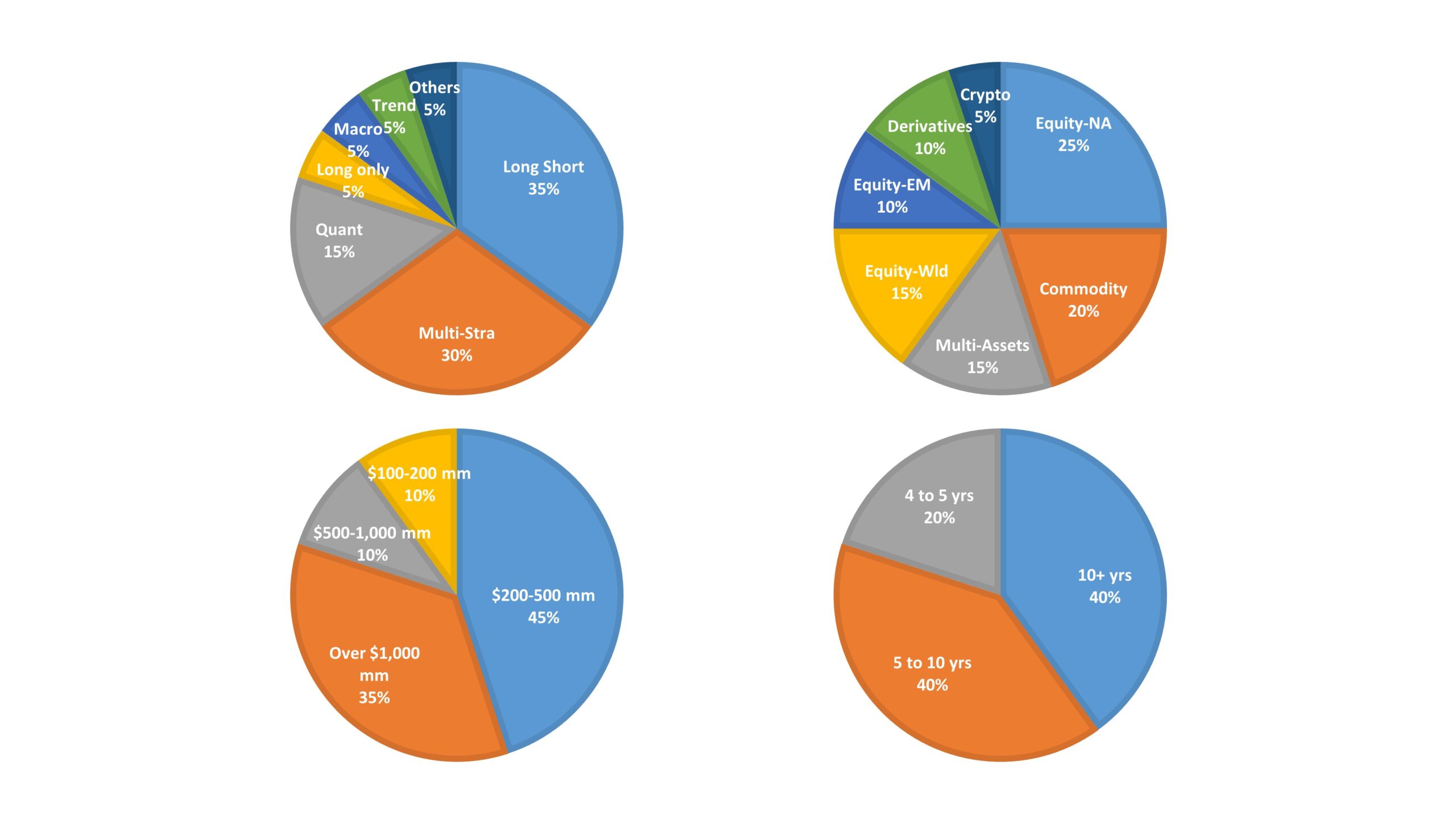

Lastly, we allocate 5% of assets under management (AUM) to each of the 20 funds in the portfolio. The following chart shows that this example portfolio, while skewed towards equities as an equity-like portfolio should, is well diversified.

Chart 1: Portfolio allocation by strategy, asset class, fund size, and years of track record

Table 1 & Figure 1 show that this portfolio has a superior performance over benchmarks from April 2019 to March 2024¹.

Table 2 & Figure 2 illustrate the power of diversification given that the portfolio only has 20 funds and several are volatile.

A word of caution if you are intrigued. This example only contains 5-year data from April 2019 to March 2024, representing a simple snapshot. Past performance is no guarantee of future returns. Nevertheless, this example shows that outstanding funds exist. With effort, investors can certainly assemble a portfolio of hedge funds to beat the market. Please check our Marketplace to learn more.

A word of caution if you are intrigued. This example only contains 5-year data from April 2019 to March 2024, representing a simple snapshot. Past performance is no guarantee of future returns. Nevertheless, this example shows that outstanding funds exist. With effort, investors can certainly assemble a portfolio of hedge funds to beat the market. Please check our Marketplace to learn more.

Note:

- Portfolio returns are net of all expenses of component funds but do not include costs of managing the portfolio

- SPGSCI is the Goldman Sachs Commodity Index maintained by S&P

Investors can assemble a high-quality portfolio of hedge funds on their own. However, it requires experience and effort. It is a full-time job to keep up with the market, monitor investment managers and their performance, find outstanding new managers to replace those who no longer perform at desired levels. Investors also need to regularly rebalance a portfolio to maintain proper allocations.

For investors having no time or desire to shoulder the load of hedge fund investing, a managed portfolio of hedge funds, known as a fund of hedge funds (FoFs), could be a solution. A FoFs handles manager selection, portfolio construction, and investment monitoring for investors.

A fund of funds, however, charges management and/or performance fees for their services, adding to the fees already charged by hedge fund managers. Investors need to ensure that a FoFs net returns – returns after all expenses – justify its fees. Please check our Marketplace to learn more.